美联储降息前景扑朔迷离 | 经济学人社论

1

思维导图:

May Li,男,我要去追逐心中的太阳,还要继续努力的亚古兽

最新资讯:美联储5月FOMC(Federal Open Market Committee)会议

在Federal Reserve issues FOMC statement中,开篇先评价美国当前经济局面:经济活动继续以稳健的步伐扩张。就业增长保持强劲,失业率保持在较低水平。通胀在过去一年有所缓解,但仍处于高位。并直言“In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective. ”

随后讲了一些措施,如:

1)继续将联邦基金利率目标区间维持在5.25%-5.5%的区间;

2)继续减持国债、机构债务和机构抵押贷款支持证券;

3)从6月开始,委员会将把美国国债的每月赎回上限从600亿美元降至250亿美元,从而减缓其证券持有量下降的速度。委员会将维持机构债务和机构抵押贷款支持证券的每月赎回上限为350亿美元,并将超过这一上限的任何本金支付再投资于国债。

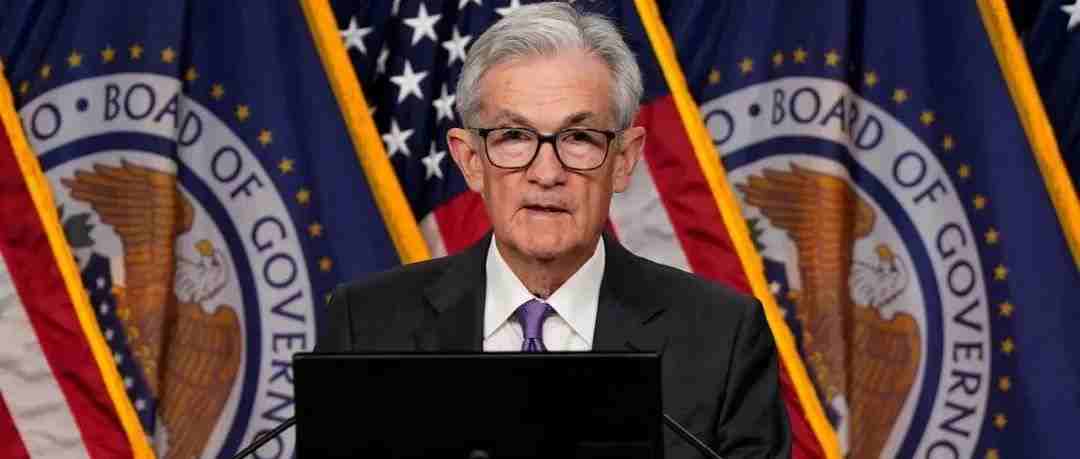

在鲍威尔的记者发布会上,当面对是否有加息可能性的问题时,鲍威尔直接表示:I think it's unlikely that the next policy rate move will be a hike. I'd say it's unlikely.以及 So the policy focus has been on, has really been on what to do about holding the current level of restriction.

面对AP NEWS记者的提问:“那么,美联储是否已经放弃了宽松政策的倾向?你怎么看?”鲍威尔表示:“我们对政策利率的决定将取决于即将公布的数据、前景如何演变以及风险平衡……”并指出:So I think, and we think, that policy is well-positioned to address different paths that the economy might take. 由此指出了3条不同的paths:

1)推出降息在这种情况下是合适的:if we did have a path where inflation proves more persistent than expected, and where the labor market remains strong, but inflation is moving sideways and we're not gaining greater confidence, well that would be a case in which it could be appropriate to hold off on rate cuts.

2)if that inflation is moving sustainably down to 2 percent;

3)another path could be an unexpected weakening in the labor market.

也就是说,如果通胀率达到2%的目标,或者劳动力市场降温,那么就可能降息。所以鲍威尔在发布会上对降息的态度是十分朦胧的。

链接:

https://www.federalreserve.gov/monetarypolicy/fomcpresconf20240501.htm

2

英文部分选自经济学人20240420社论版块

翻译组:

zy,当下快乐就是意义

Ryan,学海无涯,译无止境

Cassie,ECNU口译小菜鸡,体制内摸爬滚打教书匠

校对组:

UU,保持低调

Shulin,时间是个好东西

Rex,The one who widens your English~

3

本期感想:

Neil,男,外贸民工,经济学人铁粉

一鲸落,万物生。美联储的加息或者降息牵动全球市场的神经。现在大多数国家都期待着美国能降息,但是通胀向上抬头,降息的预期持续下降,不排除加息的可能性。这样一来,各国将承受资本外流的压力。当然每个国家的情况有所不同。

对出口导向性的国家,美国加息,美元升值,本国货币贬值,有利于出口,向越南/韩国/土耳其。但是对于进口导向性的国家,进口的成本就增加,像印度/日本。这里会有一个特殊的问题,我们也是一个出口多的国家,我们是希望加息还是降息呢?人民币贬值有利于出口,现在三驾马车中的外贸出口是受益者。但是我们反而更希望降息。因为house压力很大,加息,使得偿还美债的成本增加,无疑对house产业是雪上加霜。RMB的贬值也不利于吸引外资,股票市场也会受到影响。资本是逐利的。来了之后手上的资产在缩水,也就没有来的动力。所以总体来说,我们是希望降息的。

现在的情况不能指望美联储降息,只能另谋出路。现在基本有两个预期:今年预计还会有一次降息,缓解市场流行性的问题。第二个是加快人民币国际化,现在人民币支付在全球拍第四,比例依然较低,这个任务重要但是非常艰巨。要撼动美元地位非一朝一夕,长期战役。

4

愿景

打造

独立思考 | 国际视野 | 英文学习

02 经济学人打卡营

每周一到周六阅读经济学人

并在群里以及小鹅通内写分享

分享是文章的总结或者观点或者语音打卡

字数不少于100字,中英文都可以

群里每周免费分享最新外刊合集

最新评论

推荐文章

作者最新文章

你可能感兴趣的文章

Copyright Disclaimer: The copyright of contents (including texts, images, videos and audios) posted above belong to the User who shared or the third-party website which the User shared from. If you found your copyright have been infringed, please send a DMCA takedown notice to [email protected]. For more detail of the source, please click on the button "Read Original Post" below. For other communications, please send to [email protected].

版权声明:以上内容为用户推荐收藏至CareerEngine平台,其内容(含文字、图片、视频、音频等)及知识版权均属用户或用户转发自的第三方网站,如涉嫌侵权,请通知[email protected]进行信息删除。如需查看信息来源,请点击“查看原文”。如需洽谈其它事宜,请联系[email protected]。

版权声明:以上内容为用户推荐收藏至CareerEngine平台,其内容(含文字、图片、视频、音频等)及知识版权均属用户或用户转发自的第三方网站,如涉嫌侵权,请通知[email protected]进行信息删除。如需查看信息来源,请点击“查看原文”。如需洽谈其它事宜,请联系[email protected]。