报税身份辨析

在银行账户申请的细则里(比如最近大热的 Discover Checking Account),经常会见到一些词让大家一头雾水,例如 “Under penalties of perjury, I certify that: I am a U.S. citizen or other U.S. person.”。什么是 U.S. Person?什么是 Resident Alien?跟 Permanent Resident 有什么区别?这些词语在报税的意义下,都是有严格定义的,我们将在此文中按照 IRS (Internal Revenue Service) 给的官方说明向大家尽量解释清楚这些身份之间的区别与联系。注意本文谈论的是信用卡/银行账户相关的定义,因此讨论的其实是W9/W8表格中的定义,即联邦税,州税的resident定义有所不同,大家在报州税的时候请不要参考本文。

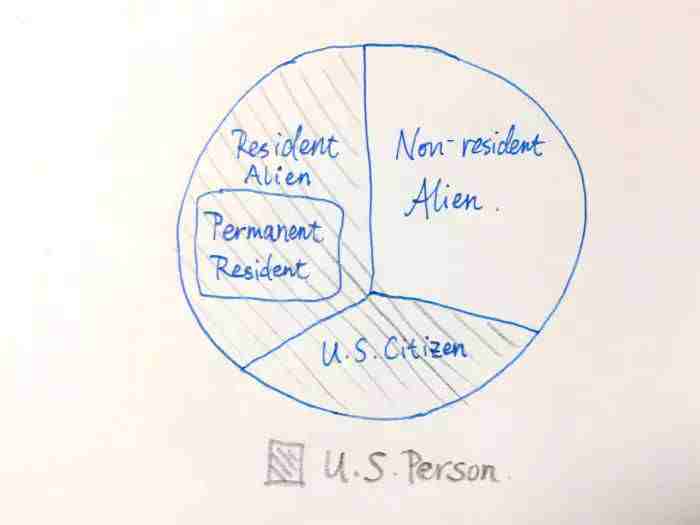

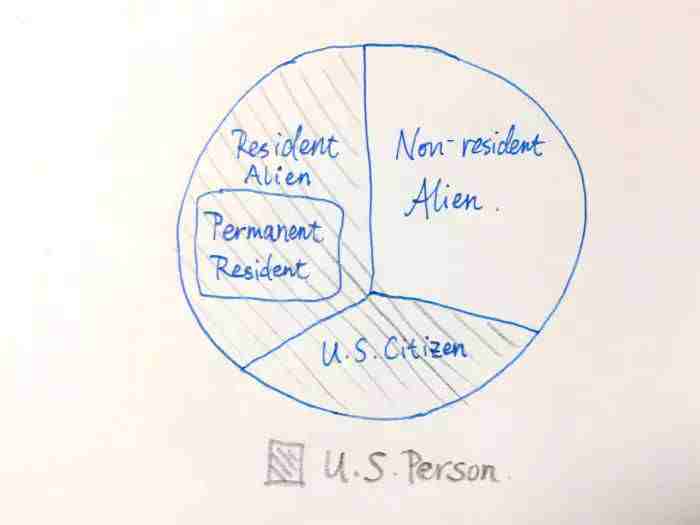

几种身份的关系示意图

1. U.S. Citizen(美国公民)

这个我想不太需要解释,自己是否是美国公民大家应该都很清楚。需要强调的一点是,如果你并非美国公民,而在办信用卡/银行账户的时候勾选上了我是美国公民的选项,是严重的谎报身份,可能会影响到绿卡的申请,大家一定要谨慎。

2. Lawful Permanent Resident (Green Card Holder) (绿卡持有者)

这几个词都是绿卡的意思,自己是否持有绿卡我想大家也都很清楚。

3. Alien

只要不是 U.S. Citizen,你就是 Alien。Alien 分为两种:Resident Alien 和 Non-resident Alien。

4. Resident Alien

若你是绿卡持有者,或者满足以下条件(substantial presence test),你就是 Resident Alien:

重要的是上述判据要排除掉一些情况:

Definition of Exempt Individual

其中对很多人最重要的一条是,F1/F2身份的前5年一定是 Non-resident Alien!J1/J2身份的前2年一定是 Non-resident Alien!

5. U.S. Person

U.S. Person 的定义包括 U.S. Citizen 和 Resident Alien,不包括 Non-resident Alien!

Discover Checking Account 开户的时候有一条细则是让你确认你是 U.S. Person 的,不勾选上则无法申请。如果谎称身份Discover应该不会查,但是对于可能存在的未知风险请自负。

欢迎大家在下方留言参与讨论~如果你觉得本文有用,别忘了点击右上角分享给你的朋友们哦~

阅读原文 最新评论

推荐文章

作者最新文章

你可能感兴趣的文章

Copyright Disclaimer: The copyright of contents (including texts, images, videos and audios) posted above belong to the User who shared or the third-party website which the User shared from. If you found your copyright have been infringed, please send a DMCA takedown notice to [email protected]. For more detail of the source, please click on the button "Read Original Post" below. For other communications, please send to [email protected].

版权声明:以上内容为用户推荐收藏至CareerEngine平台,其内容(含文字、图片、视频、音频等)及知识版权均属用户或用户转发自的第三方网站,如涉嫌侵权,请通知[email protected]进行信息删除。如需查看信息来源,请点击“查看原文”。如需洽谈其它事宜,请联系[email protected]。

版权声明:以上内容为用户推荐收藏至CareerEngine平台,其内容(含文字、图片、视频、音频等)及知识版权均属用户或用户转发自的第三方网站,如涉嫌侵权,请通知[email protected]进行信息删除。如需查看信息来源,请点击“查看原文”。如需洽谈其它事宜,请联系[email protected]。